Student Debt Relief

December 2, 2022

The Biden-Harris Administration, in collaboration with the U.S. Department of Education announced a three-step plan to help lower and middle-class people to recover from student debt. As of Nov 11, 2022, less than a week from since the portal opened, a federal Judge in Texas declared it illegal, leading to the stop of application submissions. When the site was blocked there were 26 million applications in the system.

The three parts of their program were to not only benefit students, but to uplift and support education. They were focused on making the loan payments as easy as possible and attempting to eliminate all unnecessary issues.

Part one was to conduct the final extension of the student loan payment pause, meaning the return of the pre-pandemic payment system.

The second part was to reach the targeted audience, low to middle-class families.

The third and final part was to create a loan system that was more accessible and manageable to all future borrowers.

Under the original plan, which is now blocked, students were eligible to receive anywhere from $10,000 to $20,000 for debt relief purposes. If you received the Pell Grant, a need-based federal financial aid that usually does not have to be repaid, you are eligible to receive $20,000 at most.

If you didn’t receive the Pell Grant, you can only receive up to $10,000. You are also eligible to take part in the Biden-Harris Debt Relief Program or Public Service Loan Forgiveness (PSLF) if your individual income falls below $125,000 or your household income is below $250,000.

This program would have benefited many people and created even more opportunities for the generations to come in terms of more accessible education. For more information and access to the application, head over to the Federal Student Aid website.

Aubrey Camp • Dec 16, 2022 at 1:43 pm

On December 2nd, Tere Quezada wrote an article titled “Student Debt Relief”. The article mentions the Biden-Harris administration is collaborating with the U.S. department of education, creating a three-step plan to help lower and middle class people recover from student debt. It mentions that less than a week after the portal opened, a federal judge in Texas declared it illegal, the site was blocked with 26 million applicants in the system. I like that she mentions how this three-step plan will not only benefit students, but it will support and uplift education. The article easily explains how the three-step plan would work, it mentions that the first part was to conduct the final extension of the student loan payment pause, the second part was to reach the low and middle class students, and the third was to create a loan system that was accessible to future students. It also mentions that under the original plan students were eligible to receive anywhere from $10,000 to $20,000 for debt relief. The article also adds that if you receive the Pell Grant, which is a need based grant that is federally financed and usually would not need to be repaid you would be able to receive $20,000 at most. I love how this article mentions that this program would have benefited many people and helped create jobs and opportunities for generations to come, by giving them a better access to education.

Jenna De Jong • Dec 16, 2022 at 9:37 am

On December 2, Tere Quezada wrote an article titled “Student Debt Relief” In the article it goes into detail about the three step plan to help lower and middle class students to recover from student debt. However, a week before the portal was to open, a federal judge from Texas declared it illegal. With there already being about 26 million applications sent in, I find it crazy how it was deemed illegal. Student debt is a major issue in our society today especially with college attendance increasing. Some people still continue to struggle with student debt long after they finish college and further down the road, and it’s a hard pit to climb out of. I just think it’s sad that something that could have benefited so many people and opened up more opportunities, got turned down. All in all, you did a great job on this article! Student debt is a serious issue and I’m glad that you were able to bring light to the situation. I also appreciate how you linked the federal student aid website to your article just in case anyone wanted help or just more information.

Kirk McNagny • Dec 9, 2022 at 1:48 pm

On December 2, Tere Quezada wrote an article titled “Student Debt Relief.” The article mentions that the Biden-Harris administration had come up with a plan to relieve student loan debt from people pursuing an education beyond high school. Prior to reading this article, I was not aware that this debt relief plan had been blocked. I find it to be an interesting idea but I also have some questions. What was the opposition’s reasoning for blocking it? How close was the vote to blocking the plan? Who blocked it and from which states? Was it more of a partisan issue in response to the Biden presidency? While I think that the article summed up the different effects that the plan would have had well, I would encourage the author to include any possible motives in their decision to block it. Since it is a political issue it would be interesting to see the justification of the other side for blocking a plan that would have helped so many. This being said I do appreciate how many specific details including dollar amounts were in the article. Thank you for informing me on this so little covered topic.

Camila Hernandez • Dec 9, 2022 at 1:28 pm

On November 2, Tere Quezada wrote an article titled “Student Debt Relief”. The article mentions what is being done in the United States in order to help people with their student debt. It shows how this is being done through a three step plan, specifically to benefit lower and middle class individuals. According to Quezada, the debt relief ranges anywhere from $10,000 to $20,000 and you can apply through the Biden-Harris Debt Relief Program or through Public Service Loan Forgiveness. You can reach these on the Federal Student Aid website. These resources were linked in the article which is great because it makes them easily accessible to any reader who might be interested. In addition, the article brought up the fact that this program was declared illegal in Texas. Twenty-six million applicants from this state were blocked from possibly receiving this financial help. I wonder how the declaration passed? I also wonder who brought up the topic of banning it in the first place and why? Is there any other state who also did this or is in the process of doing this? Although some were not allowed to participate, the article mentions in the last paragraph that many people have already benefited from it, and that it has created more opportunities for future students. I think this program was an incredible idea and hopefully it can encourage more people to continue their education without having to worry as much about financial issues.

Steve Ke • Dec 9, 2022 at 1:21 pm

On December 2, Tere Quezada wrote an article titled “Student Debt Relief.” I found the article very insightful and thought that it is a very relevant topic. Previously, I didn’t know what the Pell Grant plan was, and I found it interesting how the $20,000 doesn’t have to be repaid. I believe that these new financial aid plans will help a lot of students get more opportunities and access a better education. As a high school student, I already have a lot of work to do and I can’t imagine how stressful it would be to also have to worry about student debt. The program will give the people in need a chance to succeed and prevent future student debt crises.. Furthermore, I learned that Biden and Harris’ Public Service Loan Forgiveness program was announced around the 2022 midterm elections, and it likely helped the Democrats garner more votes. I think student debt is a very political topic and after learning that Texas blocked the program, I wonder how successful the program will be at shrinking the inequality gap. I find it very similar to the Affordable Care Act during Obama’s presidency and hope it can make a positive impact. Thank you for introducing me to student debt.

alissey fang • Dec 9, 2022 at 1:18 pm

On December 2nd, Tere Quezada wrote an article titled “Student Debt Relief”. College costs a lot of money, many people choose a different route in life for that exact reason, but there are a handful of kids who chose to go to school and end up with thousands of dollars of debt by the time they’re only 25. This article mentions a plan made to help students get out of debt, the Biden-Harris administration started a program to help out but after 26 million people applied it was shut down, I had heard something about them trying to help out but this article gave me a better understanding of what exactly they did. This article quickly and clearly gives you a rundown of the issue and gives you ways to continue research on the issue if interested, however, I do wonder why exactly the program was shut down, I understand it would probably be a lot of money but it was for a good cause, I also wonder why college is getting more and more expensive every couple of years. This article was extremely well written and very informative, I look forward to maybe seeing a part two in the future with more information about the foundation and maybe even some student interviews to see how other people feel about the topic.

Matthew Temple • Dec 9, 2022 at 1:16 pm

On December 8, Tere Quezada wrote an article titled “Student Debt Relief”. The article talks about the three part plan to help families pay off student debt and why it was blocked. Less than a week after it was announced, Texas declared it illegal and it was blocked. I found this really interesting because I wonder why it was blocked if only one of the fifty states thought it was illegal. I also thought that it would be nice if you could elaborate as to why the plan was blocked, and also because you said it was current to November 11, if it is still blocked or if they found a way to re-open it again. Personally, I think this plan is a great idea to help students pay off their debt and help them be more successful in the future. Because it said that in only one week, already 26 million applications were submitted, I would think that students and families are interested in this plan and would be very successful, it could help pay off so much college debt. I really hope they reopen the plan because it would be very beneficial to a lot of college students. Thank you for writing this article to help inform other students about this issue.

Sam Gunawardena • Dec 9, 2022 at 1:16 pm

This article entails the Biden-Harris Administration’s original plan for forgiving student debt before it was blocked. I was completely unaware that this was blocked, and it saddens me to know that middle and lower class families will continue to face crushing debt for pursuing education. Recently, I was talking to one of my teachers about the student debt he still hasn’t been able to pay. He was ecstatic about the debt relief plan because it had given him hope for the last $12,000 he needed to pay off. I appreciated the links given in the article for any external information, but I wish there was an explanation as to why the plan was blocked. There seems to be no substantial reason to eradicate something that would have helped so many students and their families. One of the main qualities that I factor in when choosing which colleges to apply to is cost. Some have seemingly unreasonable expenses and many families will rule out options solely for financial reasons regardless of academic prestige. 26 million applications is an unfathomable amount of people, and knowing all of them had their hopes crushed is heartbreaking. I hope the block gets overturned and students get the help they need.

Leonardo Mayorga • Dec 9, 2022 at 1:05 pm

The article talks about efforts by the Biden – Harris Administration along with the U.S. Department of Education to help lower and middle class people recover from student debt. This student debt relief plan consisted of three parts, part one being the final extension of the student loan payment pause which meant the return of the pre-pandemic payment system. This pre-pandemic payment system is something I have heard little about and it would be interesting to learn more about how it works. The second part would be to outreach to those lower and middle class families who could benefit from the plan. And finally the third part was to make the loan system more accessible and affordable for future student borrowers. I learned that the plan was blocked by a federal judge in Texas. At that point the site had 26 million applications in their system. I learned that the plan would have given eligible students anywhere between $10,000 and $20,000 in efforts to relief their student debt. With the plan now blocked I wonder how some of those applicants will be affected, especially those who were heavily counting on it. Overall I think that this is a very informative and well written article. Thank you for teaching me about the student debt relief program.

Elle Lundahl • Dec 9, 2022 at 11:42 am

On December 2, Tere Quezada wrote an article titled “Student Debt Relief” The article goes into detail about a three step plan that was announced by the U.S. Department of Education in order to help students recover from debt. After reading the article, I was shocked to have learned that a federal Judge in Texas had declared it illegal. This three step plan would have helped thousands of families and students, struggling to pay off student debt. It led me to wonder why this program would be declared illegal and what will be done now? Will the U.S. Department of Education revise this plan or construct an entirely new program for student debt relief? Considering the unreasonable expenses of universities across the country, I feel it is important to combat this issue in some way. Also, considering the amount of students who had applied for this financial aid program within a week after its release, reflects the necessity for student debt relief in our country. The article emphasizes the benefits that the three step program would have had on a large number of lower and middle class families who would have qualified for this debt relief program.

Emilia Flores • Dec 9, 2022 at 11:29 am

On December 2 Tere Quezada wrote an article titled “Student Debt Relief.” This article talks about a three-step plan announced by the Biden-Harris Administration in collaboration with the United States Department of Education to benefit students and uplift the support of education across the country. This consisted of conducting a pre-pandemic payment system, reaching an audience of lower to middle class individuals, and establishing a system that loaned money to families struggling with student loan debt, making it manageable to future borrowers. This plan was announced and soon blocked as a judge in Texas declared it illegal, stopping students from submitting applications to receive a Grant of $10,000 to $20,000. This article was very informative and properly structured, it also kept me engaged with the introduction of the problems faced when establishing this plan. I don’t understand why this plan was blocked, as it could have given families a foundation of support. Student Debt is a huge issue always occurring in today’s society so the establishment of this plan could have been extremely helpful. I’m curious as to why it would be a bad idea to initiate this plan, having any downsides or reasons that it was blocked in the first place.Thank you for informing me about this subject, I appreciate the opportunity to learn about a topic that is relevant to people around the world today.

Andres Beltran • Dec 9, 2022 at 10:56 am

On December 2, Tere Quezada wrote an article titled “Student Debt Relief”. The article mentions a three-step plan that would help individuals recover from student loan debt. Despite the efforts of the Biden-Harris Administration and the U. S. Department of Education, this plan was rejected or blocked. The plan seemed solid and consisted of returning to the pre-pandemic payment system, targeting low to middle-class individuals, and making the loan system easier to navigate. It’s interesting to see how students would have benefited from this plan. Not only would this reduce some of their stress and worry, but it would most likely improve the quality of their education as well. Many students believe that college isn’t worth it because of the crippling student loan dept. Their loan payments can make up a large portion of their income, making it difficult for them to purchase other goods and services. Additionally, if they miss a payment deadline, their credit may be lowered and additional fees may be applied. Receiving 10-20 thousand dollars for debt relief would have been very impactful for many families. With this in mind, just how many individuals would have been allotted this sum of money? Or would it be possible to give a bit to all 26 million applicants?

Karma Phang • Dec 9, 2022 at 10:55 am

On December 2, 2022, Tere Quezada wrote an article titled “Student Debt Relief”. In this article, she talks about the new three step plan that aimed to help low and middle class families. In this plan they would conduct the final extension of the student loan payment pause, reach their targeted audience, and create a loan system that was more accessible and manageable to all future generations. Under this plan, students were able to receive $10,000-$20,000 to help with their debt. However, this was blocked due to a federal Judge in Texas declaring it illegal. This article was short and simple, while including enough information on the topic. It also had multiple links that would provide more information on the topic for those who are interested. After reading it I wonder what were the differing opinions on this topic. Is there any chance for this program to come back? In the future, if it were to come back, would there be different standards in terms of income levels and how much money one could get? As someone who plans to go to college, this article was very interesting and includes a topic that may affect me and my family.

Hawking Crouther • Dec 9, 2022 at 10:52 am

December 9, 2022

Dear Corydon Editor,

On December 2, Tere Quezada wrote an article titled “Student Debt Relief.” The article describes the three step plan by The Biden-Harris Administration, that would help people with their student debt. The article gives some ground level information about the plan, so I do wish it went into more detail in the three steps. For example, when step two of the plan is mentioned, in which they wanted to reach their target audience, more detail about how they would go about it and what it would require would’ve been informative. Quezada does do a good job explaining the pell grant system and with the information provided, it makes me agree with her that this was a good system that would’ve been very beneficial to many students. A lot of careers after college take a while to start paying off, so grants and extended time for student debt seems necessary for a ton of people. The Biden-Harris Debt Relief Program also seems like a way to help low income individuals and families, and would allow them more opportunity. It leads to the question, why would it be made illegal? More information about that would have been helpful as well, but this article is overall great starting information for anyone interested in this topic.

Sincerely,

Hawking Crouther, Grade 11

Mika • Dec 9, 2022 at 10:51 am

December 9, 2022

Dear Tere Quezada,

On December 2,Tere Quezada wrote an article titled “Student Debt Relief”. This article was about how the BIden-Harris administration was a program that aimed to help middle and lower class people pay off their student debts and provide financial relief. Unfortunately, it was blocked by a federal judge in Texas naming it illegal but other financial aids continue to thrive in its place.This article has made me learn that the programs that the scholarships or financial aids provide can make a difference when paying for school fees, and the program should continue on so that it would help millions of people across the USA. One question that I have though is what are the names of the other programs that may help people with their student debt in the future? And are any in progress or in the makings behind the scenes? Thank you for writing this informational article.

Sincerely,

Mika Darmawan, Grade 11

John Pok • Dec 9, 2022 at 9:47 am

On December 2, Tere Quezada wrote an article titled “Student Debt Relief.” The article, discussing the student debt relief program issued by the Biden-Harris administration, provides insight to various benefits many students (and former students) would have received had the plan not been blocked. This article was particularly interesting to me because, while I had heard of this program before, I was unaware that it had actually been blocked by a Texas federal judge. The plan, which would have provided thousands of dollars to millions of low and middle-class students, could have relieved millions of (at least some) economic stress and burden. I find most striking the statistic mentioned in the first paragraph—a whopping 26 million applications were still in the portal system when it was blocked less than a week after opening. I wonder what arguments both sides of the issue would present; is it a political issue (knowing, Texas generally opposes the democratic party) or more simply an economic issue? I think the article itself could have placed more emphasis on the blocking of the debt relief program, maybe even mentioning reasoning for the actions of the Texas judge who ruled the plan illegal. Still, the article was quite interesting overall, and it enlightened me on a policy which I personally thought was still in active effect.

Devon Fletcher • Dec 9, 2022 at 9:44 am

The article covers what the Biden-Harris administration has done to help low and middle class families eliminate financial issues when fulfilling their college education. Prior to the article, I had never heard of many of these relief systems. Though both my parents have attended college, I still feel like a fish out of water when it comes to knowing the college system. It is a field unknown to me, especially in the financial sense. However, it is also a field unexplored. Your article is the perfect start to me exploring and answering some of my questions. I looked into some of the websites you had linked with more information but I still have more questions. “Everything You Need to Know About the Pell Grant” says that the Pell Grant has not been keeping up with the pace of the rising education cost. It says many students would need to find help in addition to the Pell Grant. Some questions this brought to me is, how much did the Biden-Harris administration fix this problem? And also, is there a limit to the amount of financial aid you can receive? And does the income recorded for your eligibility of these debt relief systems include anyone who is helping pay for your education or does it only require the student’s own income? These are some things I will continue to research, so thank you for the thoughtful links to more websites where I can do that. This was the perfect way for me to kick start my understanding of the college process.

Sincerely,

Devon Fletcher, Grade 11

Jacquelynn Gutierrez • Dec 9, 2022 at 9:44 am

On December 2, Tere Quezada wrote an article titled “Student Debt Relief” The article mentions how the Biden-Harris administration is in collaboration with the U.S. Department of Education with the intent to help lower class and middle class people relieve their student debt. This informative article then stated that the Biden-Harris administration announced a three-step plan that was elaborated on. The three-step plan was to conduct the final extension of the student loan payment pause, reach the targeted audience (low to middle-class families), then to create a loan system that was more accessible and manageable for future borrowers. However, the original plan was blocked so it makes me wonder why this plan was blocked. Either way this article was quite informative and is an important topic considering the audience are high school students who may or may not wish to seek higher education, thus likely to have to deal with student debt. It was a nice addition to the article to involve other information about student aid, including the Federal Student Aid website, because this information is highly beneficial for future or even current college students. In fact this topic is surely one many would love to learn more about. Overall, this article was well-structured in a way that the issue was introduced then was followed by potential solutions students can seek. Therefore, thank you for educating us on such an important issue and for delivering insight for potential resources that would help advance many students’ academic success.

Kai Yamamoto • Dec 9, 2022 at 9:41 am

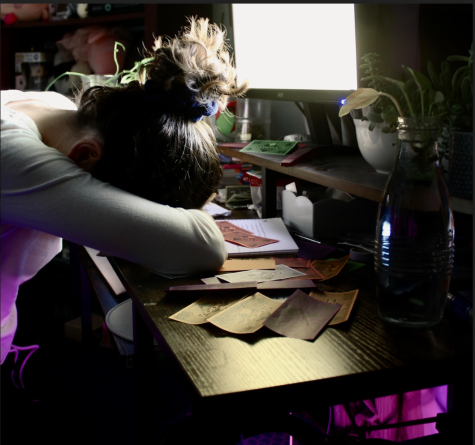

The opening image of the article shows a stressed out student in the library with a stack of books labeled with “Debt”, “Student Loans”, and “$$$.” The article immediately transitions to the Biden-Harris Administration and its collaboration U.S. Department of Education. Ms. Quezada explains their three-step plan for the purpose to relieve student loan debt off of students from low to middle-class families. The author also mentions the pell grant, which some students are unaware of. This benefits students to know some of the opportunities they can get money for school without having to possibly pay off a debt for the latter fifthteen years after graduation. I also like how the author gives the students a link to be able to learn more about financial aid. One suggestion I would make is to also remind the student to do their own research to see which colleges offer certain scholarships. Many colleges also offer support to those perceived as ethnic minorities and even some who are part of the LBGTQ+ community. Thank you for bringing such an important topic to the corydon. It will really save a lot of stress and it could help countless others who are in need of financial aid!

Devon Fletcher • Dec 9, 2022 at 9:40 am

The article covers what the Biden-Harris administration has done to help low and middle class families eliminate financial issues when fulfilling their college education. Prior to the article, I had never heard of many of these relief systems. Though both my parents have attended college, I still feel like a fish out of water when it comes to knowing the college system. It is a field unknown to me, especially in the financial sense. However, it is also a field unexplored. Your article is the perfect start to me exploring and answering some of my questions. I looked into some of the websites you had linked with more information but I still have more questions. “Everything You Need to Know About the Pell Grant” says that the Pell Grant has not been keeping up with the pace of the rising education cost. It says many students would need to find help in addition to the Pell Grant. Some questions this brought to me is, how much did the Biden-Harris administration fix this problem? And also, is there a limit to the amount of financial aid you can receive? And does your the income recorded for your eligibility of these debt relief systems include anyone who is helping pay for your education or does it only require the student’s own income? These are some things I will continue to research, so thank you for the thoughtful links to more websites where I can do that. This was the perfect way for me to kick start my understanding of the college process.

Sincerely,

Devon Fletcher, Grade 11

Michael Bueno • Dec 9, 2022 at 9:22 am

On December 2, Tere Quezada wrote an article titled “Student Debt Relief”. The article mentions a three-step plan that will essentially help lower and middle-class people recover from student debt. I liked how you mentioned that this three step plan will not only help students recover from debt, but how this plan can benefit the education system by eliminating any potential issues. The three step plan is very interesting because I liked how you mentioned the target audience. Making sure that people who aren’t doing the best financially can still have a great education. The plan also seems very simple, like it’s not complicated to apply and I liked how easy you made it seem. I really liked how you mentioned numbers. It’s very specific details which is great. Being able to receive $10,000-$20,000 for student debts just seems incredible and I wished this plan wasn’t blocked because it would have been able to change so many lives. I also liked how you mentioned other alternatives that will help solve student debt. Overall, I enjoyed reading this article. I haven’t heard anything surrounding this topic at all so thank you for bringing this to my attention. Great story!

vidafe taylor • Dec 9, 2022 at 9:17 am

On December 2, Tere Quezada wrote an article titled “Student Debt Relief”. The article focuses on the 3 step plan announced by the biden-harris administration in collaboration with the United State department of education. Quezada did a very informational summary of the plan, while also keeping the article easy to read. I thoroughly enjoyed how even such a serious topic that may someday affect many students at Millikan was written about with a tasteful amount of commentary. I fully agree with Quezada when they say ‘This program would have benefited many people and created even more opportunities for the generations to come in terms of more accessible education’, and I think it’s super important for our generation along with other younger generations pay attention to what opportunities are being given and taken from individuals who may have really needed them. Many older generations are claiming it is ‘unfair’ to offer student loan forgiveness now that they have already had to work to pay off their loans, and while this perspective may have been understandable when it was possible to live comfortably and still pay off loans, with the modern economy it would be illogical to continue the cycle of debt among young adults just trying to get by in a studio apartment. I appreciate Quezada writing about this topic, as it is important to bring attention to since many students may not be aware of the financial aid opportunities available to them until they are already gone. Great article.

Anandi • Dec 9, 2022 at 9:15 am

I really enjoyed how the writer showed clearly what the purpose of the article was. The topic of this article is very important and relevant considering that student debt is definitely on many students’ minds right now as seniors are applying for colleges and the idea of a large student debt may push those away from their first option for college as they don’t want to live their life worrying about paying off their debt. The idea of debt relief could be very comforting to those who are stressing about debt. I wish though that the article had included why the plan before this failed and what is different now to make sure it doesn’t fail. I feel like this would have added an opportunity to be able to contrast and compare the two plans for those who have never heard of the original debt relief plan.But I think this three step plan is at least moving in the right direction in terms of benefiting both the students and education system, especially with the target audience being middle to lower class residents.

Klarisa Hernandez • Dec 9, 2022 at 9:09 am

On December 2, Tere Quezada wrote an article titled “Student Debt Relief”. This article talks about the three-part program that the Biden-Harris Administration and the U.S. Department of Education wanted to use as soon as possible. This program would upload and support education along with benefiting students. The fact that this program was labeled as illegal in Texas put a hold on application submissions and sort of slowed the process considering there were 26 million applications. The way that this program isn’t supported in a lot of states in the United States kind of confuses me because it would be a step towards helping those who are in debt. This would be life-changing for so many people because it’s pretty common to pay for student loans until the day you die in this country. Therefore, getting thousands of dollars to help you would definitely not hurt anyone in the long run. I am thankful that you wrote about this issue because I had no idea that this was going on, but now I do. I believe there should be more done to help those with student debt since it is so stressful for so many people in our nation. More people should want some change regarding this, thank you for shedding light on this topic.

Elias Hershfield • Dec 8, 2022 at 1:35 pm

On December 2, Tere Quezada wrote an article titled “Student Debt Relief¨ This article talks the audience through the steps needed in order to enable a student debt relief plan. I really enjoyed reading this article because it is such a controversial topic and would be such a benefit for students that are in debt. I don’t know much about this topic, but If I were paying to go to college but couldn’t afford it, a debt relief plan would be awesome. I also loved how the author put in the time and effort to find a website that would lead us to more information over the topic at the end of the article. Since this is a relatively new topic to me I do have a few questions. Why did the federal judge in Texas declare the student debt relief plan illegal so fast ? Are there any countries or states that currently have a student debt relief plan ? What are some pros and cons about the plan ? How long would the plan need in order to take effect ? How many individuals are there currently in the U.S. that have student debt ? Overall, I found the article entertaining to read and neatly organized. If there was a vote to have this plan take action I would definitely vote yes.

Emmett Wechsler • Dec 8, 2022 at 1:26 pm

On December 2, 2022 Tere Quezada wrote an article titled “Student Debt Relief”. The article talks about a three-step plan created by the Biden-Harris administration and the U.S. Department of Education to help lower and middle-class people recover from student aid. The plan was essentially meant to make the loan system easier, and more accessible for the targeted audience, being lower to middle-class people. This article is very interesting because I know that student debt is a very big issue, but I never heard too much about it and what is being done to help. This article was my first time hearing about this plan that was attempted. I wonder why the Texas federal judge decided to block the plan, as this is for a good cause and a big issue that affects countless people across the country. I am not fully sure what the first step of the plan was, or what the pre-pandemic payment system was. I really hope they either unblock the program, or come up with a similar one that does not get blocked as this would help countless people and solve many issues within the U.S. I very much enjoyed this article and hope to learn more about this topic soon.

Danielle Nabong • Dec 8, 2022 at 1:14 pm

I found this to be a very interesting article, as it mentioned a supposed solution to one of the United State’s biggest economic problems, student debt. The piece explained the Biden Administration’s three-step plan to help low and middle-class families pay their student loans. However, it was sadly postponed as Texas declared it illegal. As a student who will shortly be applying to universities and must consider the economic burden this places on my parents and I, I found this article intriguing. Especially since I could soon be in a situation in which I would benefit from this program. Furthermore, I appreciated that the author went into detail about the different grants available to students. It helped me better visualize just how much money students could have gotten. Allowing me to understand why it received 26 million applications in such a short amount of time. It leaves me to wonder whether or not this program will ever be active again. This is why I would have appreciated it if the author included if anything was being done to protest Texas’ claim of it being illegal. Nonetheless, it was a very informative article that explained the student debt relief program well.

Alexis Hooper • Dec 8, 2022 at 1:05 pm

On December 2, Tere Quezada wrote an article titled “Student Debt Relief.” The article mentions how the U.S. Department of Education and the Biden-Harris Administration teamed up to help students with their debts. Going into this subject, I knew that financial problems have been significantly worse for the last three years due to the COVID pandemic. The pandemic led to businesses shutting down and many people losing their jobs. To hear that these organizations are offering generous amounts of money to low and middle class students is very pleasing. This is because colleges are pretty expensive, especially for students who want to go to private universities. It is devastating to note that many students have to turn down acceptances from their dream schools, since they can afford the tuition and other costs. Now that people are dedicating more attention to this issue, the education of more students will be supported and not only will they be able to continue their education, but they will be able to potentially pursue their future dreams or goals in life. I also like how the article described the plan and any alternatives if students couldn’t achieve the Pell Grant. It shows how there are multiple opportunities available for people struggling financially, which will make lots of low income families satisfied. I also know that there are various scholarships available for students with financial issues which award thousands of dollars to those who get it. Thank you so much for further information on this issue because it is an ongoing problem that many families need assistance with. I am sure that all these programs will do great things.

Devlyn Mahan • Dec 8, 2022 at 12:46 pm

Dear Corydon Editor,

On December 2nd, Tere Quezada wrote an article titled, “Student Debt Relief”. Her essay really helped to shine light on a topic I did not know much about. I really liked the breakdown of the parts to the Student Debt Relief program issued by the Biden-Harris administration, and her shining light on the topic made me start to wonder about my future as a student, with college applications right around the corner and the stresses of preparing for college as well. The information she provided about the income brackets and student loan reserves was quite helpful and interesting, and her provision of the Federal Student Aid website was a nice addition to her topic. Overall, I appreciated the topic and the necessary components she added to shine light on her topic in our changing world as students and teenagers.

Sincerely,

Devlyn Mahan, Grade 11

Kurt Buss • Dec 8, 2022 at 11:52 am

On December 2, Tere Quezada published an article entitled, “Student Debt Relief”. I thought this article was very interesting and I enjoyed reading about the original plan. This article was also informative in many ways because soon I will need to apply for college and finding financial aid is a large part of this process. College can be expensive so I think this plan was a good idea to support students who are striving for a better education. The fact that it was blocked is confusing for me as I think it has the potential to help a lot of people but, hopefully soon they will find a way to institute new plans so college students can receive the financial support they need. I found it shocking that there were 26 million applicants in the system before it was taken down. In the future, I hope our generation will be able to build off the elements and ideas of this plan because I believe that plans like these go towards an important and influential cause. Education should be top priority and I think this relief plan acts as one of the first steps towards a country where paying for college won’t be a challenge for students.

Rolo Cruz • Dec 8, 2022 at 11:36 am

On December 8, Tere Quezada wrote an article titled “Student Debt Relief”. The article features the key and vital parts towards the student debt relief programs, and emphasizes the benefits of the plan. I was happy to know that the relief program gave struggling students an opportunity to succeed in their education, but also surprised to see the program become blocked. Having a brother in college, I can see the consequences and stresses with a job, apartment, and bills, so keeping the student debt relief program could prove extremely beneficial for those who may need it more. Additionally, knowing that the plan helps lower to middle class students is extremely instrumental since these students are usually held back by their income. It was also reassuring to know that about 20,000 can go to a student or adult in need, and even if you do not receive the full 20,000, the student can still receive 10,000. Not only does the program help you with your debt, but also keeps the pressure off of parents to support their children. While taking colleges into consideration, I need to understand the pressures that may come due to monetary stress, and knowing that a plan such as the relief program has benefited students, gives me more stride to continue pursuing colleges.

Jayla Walker • Dec 8, 2022 at 11:28 am

On December 2, Tere Quezada wrote an article titled “Student Debt Relief.” This article discusses a three-step plan announced by the Biden-Harris Administration, in collaboration with the U.S Department of Education. This plan aims to help students from lower-income households recover student debt. Unfortunately, Quezada explains that the application submission for this plan was stopped by a judge from Texas declaring it illegal. As a student who is currently preparing for the college application process, I found this to be a bit unjust. I believe this plan would have been extremely helpful for students like me who will find it difficult to recover from debt after college or university. I am very curious to know if they will find a way to issue this Biden-Harris Debt Relief Program plan further down the line. I really think it can help a lot of people and improve accessible education for the next generation. Furthermore, I greatly appreciated Quezada adding a link to the Federal Student Aid website for students who are interested in helpful resources to reduce student debt. This article was so informative and interesting. Thank you so much for sharing with me!

Cristian Rodriguez • Dec 8, 2022 at 11:13 am

The article mentions the stress that college students may have to go through due to student debt. I feel that the Biden-Harris Administration is doing a good job for students in financial trouble, but there is one major problem that I see. It seems extremely unfair for students who have already gone through the troubles of paying off their student loans or to those who have no loans. Also, where would this free money be coming from? Would this mean a raise in taxes for everyone? Would this free money boost the economy and maybe even cause more inflation? Other than that, this would definitely be beneficial for the college students and their families who are in major debt, especially the lower and middle class families. This will also help with education because students will be focused less on money and more on their classes. I have also heard that this relief can help with advancement in gender and racial equality. In the end, I feel that this administration should really be taken into consideration, weighing out the pros with the cons. Thank you for letting me know about this plan as it may help me in the future.

Madalena Gonzalez • Dec 8, 2022 at 10:53 am

On December 2, Tere Quezada wrote an article titled “Student Debt Relief” The articles mention how Joe Biden had a 3 step plan to help the lower and middle class to recover from debt. People would be able to earn 10-20k, but the website was shut down due to a judge deeming it illegal. This plan would have been great to help people from worrying about debt after finishing college. It would allow more people to go to college since they wouldn’t have to worry about how much it would cost. I did have a few questions since it seems weird for it to be illegal. Why did the judge declare it illegal? Did it go against the law? Are there any plans to bring it back? It’s surprising for this program to be illegal since it wouldn’t only benefit the person who applied but everyone around since most of the time, people ask parents for money. I am also wondering since it was an application, did anyone get accepted before it shut down? I hope they bring the program because so many people can benefit, especially since the article states that there are 25 million in just one week. It’s good this article was written because it brings attention to not only the issue but the program. Since a lot of people wouldn’t have known there was this program.

Andrew So • Dec 8, 2022 at 10:48 am

On December 2nd, Tere Quezada wrote an article titled “Student Debt Relief”. The article states that the relief would target low-middle class families to recover from student debt. It also goes on to say that students would receive around $10,000 – $20,000 for debt relief purposes. Just wondering, why did the Texas judge declare the portal for the applications to be illegal? I also agree that the program has helped millions of people and along with future generations as well, giving them more opportunities without worrying about too much debt. But why did the Biden-Harris Administration and U.S. Department of Education suddenly wanted to provide relief to students so suddenly? How much would an average student owe debt to in college? Considering the debt relief gives out more than $10,000, student’s debts must be really high. Was there a motive for the department and administration to finally announce this relief? Is applying for the Pell Grant and getting accepted easy? You also stated that there were 2 other types of reliefs which are Public Service Loan Forgiveness and Biden-Harris Debt Relief Program. How much would these 2 reliefs compensate if you were accepted by them? Thank you for introducing me to this topic!

Natalie Heilig • Dec 8, 2022 at 10:44 am

On December 2, Tere Quezada wrote an article titled “Student Debt Relief.” The article briefly explained the implementation and process of receiving aid with student loan debts that was recently implemented by the Biden-Harris administration and the U.S. Department of Education. The explanation of how the program works provides a helpful look into our country’s economic and political spheres. Additionally, the article provides the motivations behind and goals of this program, offering the reader a more comprehensive understanding of the plan itself in the context of this article. At the beginning, Quezada states that a federal judge in Texas declared the financial plan illegal, meanwhile millions of applications for debt relief were already in the system. This juxtaposition highlights the controversial nature of politics and decisions in today’s current political climate. I thought the execution of explaining the program was done very well. I also appreciated the link to the government website dedicated to the plan as someone who is interested in learning more about topics such as this. I wish there was more about the tensions or disagreements surrounding the program to show the reality of our political world today, but overall this article was written very well and informed the audience about the program very effectively.

Kyle Hunt • Dec 8, 2022 at 9:55 am

On December 8, Tere Quezada wrote an article titled “Student Debt Relief”. Overall, the article is brief and leaves enough links to extend the reader’s research if they’re interested in doing so. I would have liked it if the article went into detail as to why the plan was blocked so the reader can settle whether or not the block was justifiable. In other words, reporting on the reason for the block would create a counter-argument in the reader’s head and help them form a proper opinion on the issue. I do like the way the article is structured. In the paragraphs that explain the three parts to the program, they are brief and easy to digest for the reader. I wonder what the pre-pandemic payment system refers to, or if the article already mentions it and I misread it. I really like how the problem was given as the introduction to the article, then slowly reveals the anticipated results if the problem didn’t happen. The article does not use complex vocabulary, meaning it’s very quick and unambiguous to read. This helped me stay engaged with the article and not get confused and distracted by vocabulary I’ve never seen before. I enjoyed the article and got more intrigued in a topic I would have otherwise put off until college.

bridget ball • Dec 8, 2022 at 9:43 am

On December 2, Tere Quezada wrote an article titled “Student Debt Relief.” The article talks about the three-step plan made to help lower and middle-class people recover from student debt, and how it was blocked. The Biden-Harris Administration, in collaboration with the U.S. The Department of Education had announced this plan, opened its portal, and in less than a week it got around 26 million applicants before it got blocked. Before the article, I had never heard of this attempt to help students with debt. Personally, I think that it’s a great plan, and although it uses a lot of money it’s for a good cause. I do wonder why it got blocked because it seems like a very helpful plan for many people. The plan was said to allow students to receive a loan ranging anywhere from $10,000 to $20,000 for debt relief. If this plan weren’t blocked I feel many students could avoid debt with this, which I feel is a very common problem occurring in our world today. From my understanding, the original plan was blocked and even declared illegal. I was a little confused about whether there was or wasn’t an alternative to this blocking. Thank you for introducing me to this process, and informing me of its benefits.

Sincerely,

Bridget Ball, Grade 11