As announced by Gavin Newsom, the ban to stop restaurants from including unstated fees on their overall prices, also known as Senate Bill 478, is said to affect restaurant fees and hotel resort fees. The goal of this ban is to stop additional surcharges altogether from restaurants, airlines, concerts, and resorts.

“Businesses use hidden fees or junk fees to pitch an artificially low headline price to attract a customer before revealing additional charges,” said Eleanor Blume, California’s assistant attorney general, to CBS reporters on May 1, 2024. “This [ban] is part of a broader effort to eliminate confusing surcharges,” says State Senator Bill Dood.

To get into the specifics, Senate Bill 478 is prohibiting customer surcharges, also known as service fees. A service fee’s purpose is essentially a replacement for an employee’s wage, so instead of a direct hourly wage, service fees puts this role into the hands of a customer.

For a while, sit down restaurants in California have varied on whether the mandatory surcharge rule is reserved for just large parties or if it applies to all customers. Restaurants like Pho Hanoi and Gjelina, charge an 18% surcharge for every check and make it quite clear on their websites. So what restaurants aren’t showing these surcharges?

During September 2023, Reddit users all around Los Angeles reported into an online document about the restaurants they’ve gone to with these hidden fees. On this document, there are a total of 117 restaurants listed, these establishments are mainly classified by what percentage they charge and if this fee counts as a tip or not.

For a lot of these restaurants, these fees are only disclosed on the receipt. For example, The Albright, Bar Chelou, and Burger Lounge, are all restaurants in LA that charge these service fees and don’t list it as a tip on their receipts, instead are labeled as service charges.

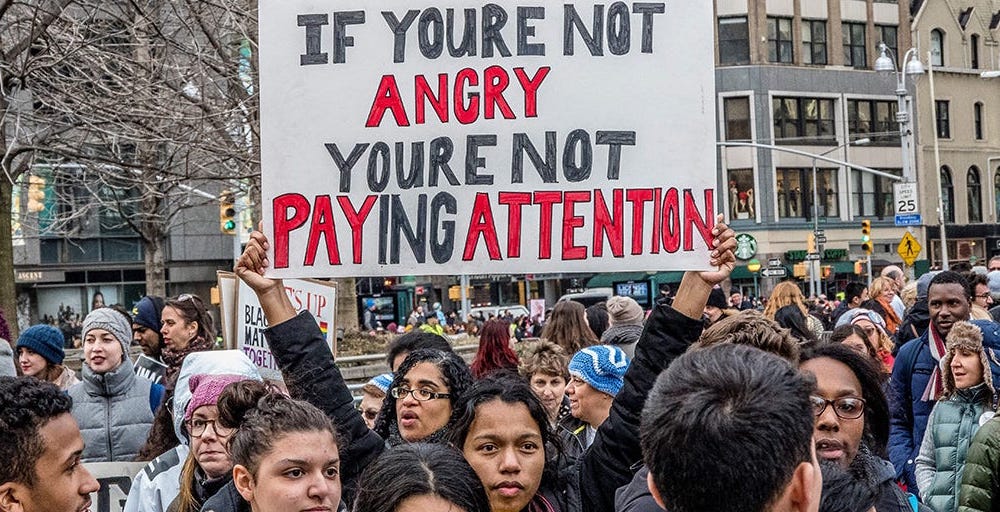

Several angry customers are also sharing their experiences online about the surcharges. “I noticed a charge on my receipt that was quite surprising…I was in such a rush that I kind of just grabbed my food, paid and left and I didn’t notice my receipt until after I had left the restaurant,” said customer Dani Dean to ABC officials on May 1, 2024. The charge that showed up on her receipt was an extra $4.03 that was disclosed as “California Employer Mandates” rather than a tip or tax. The restaurant from this interview is mentioned to be a pizza dinner near Sacramento.

“I feel that it’s unnecessary to be adding extra fees without disclosing it to customers on the menu off the bat. I understand that restaurants need to pay their employees, but that’s something that should already be added to the price if that’s what they wanted to do,” said Aubrey Bestelmeyer, a MBA freshman.

The “California Employer Mandates” and the service fees can pay for different things depending on the restaurant. It could either become an insurance for the employee that includes necessities like healthcare. Or, it could become a contributor for an employee’s wage.

According to ABC News, experts say that these charges can be legal and aren’t a new thing to California. These service fees have been booming for years in large cities like Los Angeles, San Francisco, and Sacramento. It currently seems to be becoming an official problem because of how the issue has started migrating to small towns and businesses.

As stated by LATimes, this ban was supposed to be enforced on Jan. 1, 2024. The ban was later delayed to July 1, 2024. This delay was intentionally given to allow restaurants and bars more time to adjust themselves duly.

Customers are excited, though a bit wary of what this law’s outcome will be. Items on the menu that were presented as $20 might rise to $28-30. This upcoming law came as quite a shock to restaurant owners, as the law addressed the broad term of “businesses” though owners assumed they were exempt.

Restaurants are also quite unsure of this law, not only because of the sudden transparency but because of the possible public reaction. If customers see a beloved product presented with a five to six dollar increase, they might stop attending that restaurant.

Other than general revenue, restaurants are also worried about paying their staff. As for these extra fees, on the bill they are labeled as “service fees.” In turn, other than with tips, these service fees are also how restaurant employees are getting paid. If they lose customers due to the price “increase” they won’t have enough money to properly pay their employees as they rely on the customers to pay the service fee.

Caroline Styne, a restaurant owner, has stated to LaTimes reporters, “the new law will only precipitate the closure of more restaurants, which are still recovering from the pandemic and summer strikes.”

Other restaurant owners feel the same way as Styne, stating that it’s possible that customers don’t care about restaurants closing anymore like they used to. “It’s not going to drop the price of dining out. What it might do is close more restaurants. But maybe people don’t care about that anymore,” said Laurie Thomas, an executive director of the Golden Gate Restaurant, to LaTimes reporters on Feb. 15, 2024.

For now, the outcome of this law being passed isn’t very clear, its possibilities aren’t something under the table. Whether restaurants will close down, customers will boycott, or whether these dollar signs will really make an impact will all be evident on the day of the law’s enforcement, July 1, 2024.